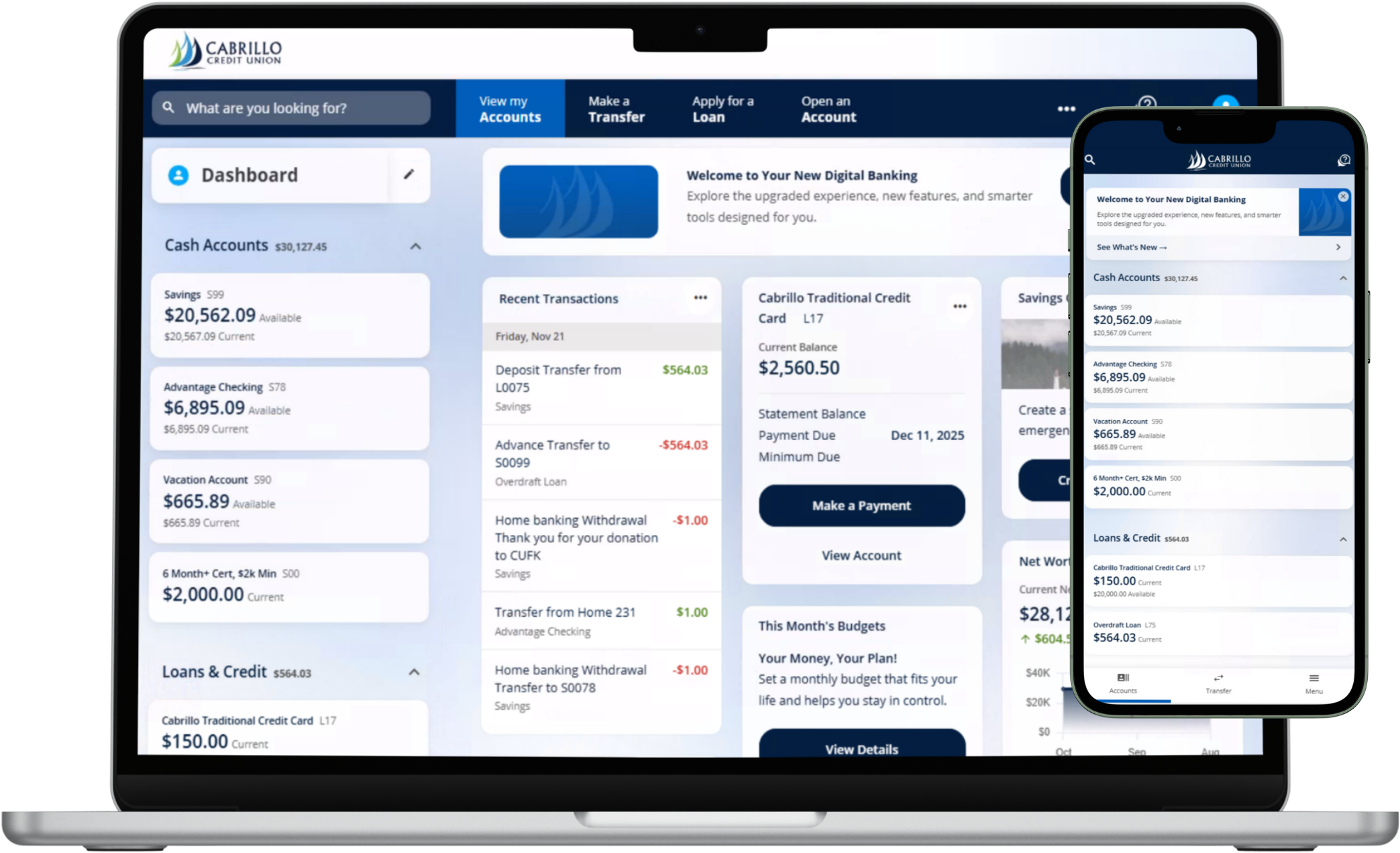

Your new dashboard puts what matters most front and center. See your balances, recent transactions, upcoming payments, and key tools in one simple view.

Updated Look & Feel

A cleaner, modern interface makes it easier to quickly scan your accounts and find what you need — no extra clicks, no clutter.

Improved Account Layout

Accounts are grouped and labeled more clearly, so you can easily tell which share, loan, or card you’re viewing at a glance.

Smarter Organization of Tools

Transfers, payments, card controls, alerts, and settings are organized into intuitive menus to help you move through tasks faster.

Streamlined Access

Quickly jump into balances, transaction history, scheduled payments, and key actions directly from your dashboard tiles.

Why It Matters

The upgraded dashboard is designed to save you time. Instead of navigating through multiple screens, you’ll be able to see your financial picture and take action from one central place.