Debit Card Usage

During parts of the transition, some NCCU debit cards may be restricted to point-of-sale (POS) transactions only. Your card will still be available for use, but with lowered purchase and POS limits. If you have any questions about these limits, please contact us and we’ll be happy to help. This is temporary and helps ensure a secure upgrade to your new Cabrillo card. If your card is one of these, you will be notified prior to the transistion.

Once your new Cabrillo debit card is activated, it will become your primary card for everyday purchases, ATM withdrawals, and digital wallet use.

Product & Account Mapping

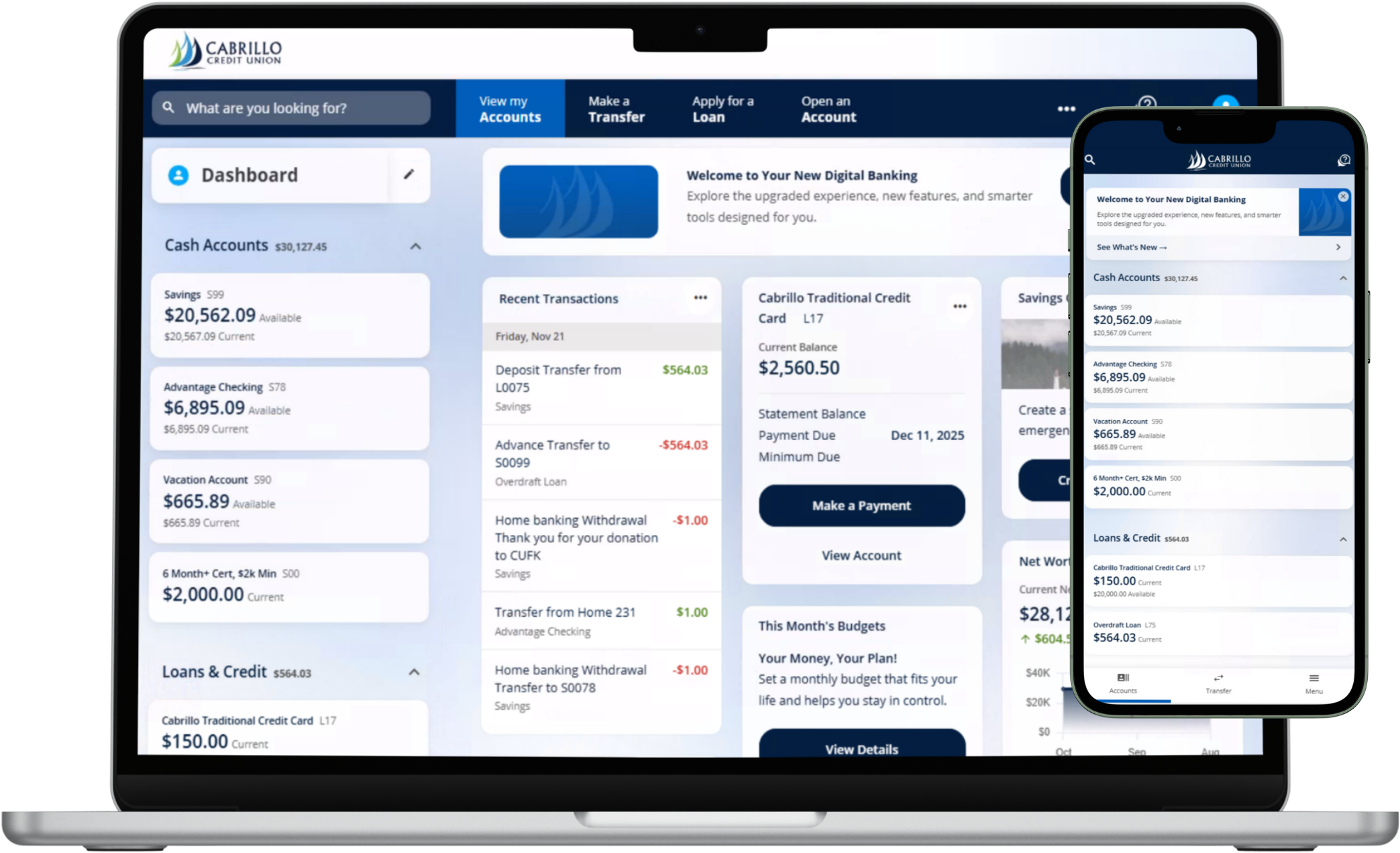

Your NCCU shares and loans will be carefully mapped to Cabrillo’s product lineup. You may notice updated product names, descriptions, or labels in your new Digital Banking view. Your balances and account history will remain intact.