What Are Account Takeover Scams?

Account takeover scams occur when a fraudster gains access to your financial accounts, such as bank accounts, credit cards, or even online shopping profiles, with the intent of committing unauthorized transactions or stealing sensitive data. They often use phishing techniques, fake text messages, or other methods to trick victims into sharing personal information like login credentials, security codes, or payment details.

Spotting a Scam in Action

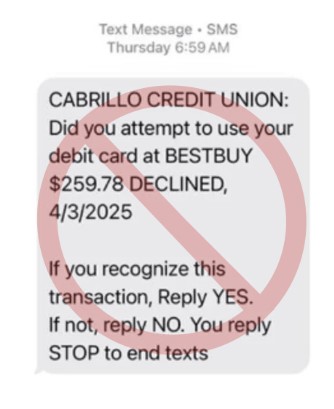

Here's an example of a common scam attempt, which looks like a message from Cabrillo Credit Union but is actually fake.

This message might appear legitimate at first glance. It claims to be from Cabrillo Credit Union, notifying the recipient of a declined transaction at Best Buy. It then prompts the person to respond with "YES" or "NO" to verify the transaction. However, here's the catch – this is a classic phishing tactic.

We want to remind you that Cabrillo Credit Union will never call, text, or email you to request your login credentials, PIN, security codes, or debit/credit card details. If you receive such a message, do not reply or click on any links.

How to Protect Yourself

While scams can be sophisticated, you can take proactive steps to secure your accounts and avoid falling victim to fraud. Here are some tips:

1. Recognize Phishing Attempts

Fraudulent messages often create a sense of urgency, like claiming your account has been compromised, to pressure you into sharing personal details. Be cautious of unsolicited communications asking for sensitive information.

2. Use Strong Passwords

Make sure your passwords are complex and unique for each account. Avoid using easily guessable information like your birth date or child’s name. Consider using a password manager to help generate secure passwords and store them safely.

3. Enable Two-Factor Authentication (2FA)

Two-factor authentication adds an extra layer of security by requiring a secondary verification step, such as a security code sent to your phone or email, in addition to your password. This makes it harder for scammers to access your accounts, even if they have your login credentials.

4. Monitor Your Account Activity

Regularly check your account statements and transaction history for any unauthorized activity. If you notice something suspicious, report it to us immediately.

5. Always Verify Directly with Cabrillo Credit Union

If you receive a message or call claiming to be from us, and you're unsure whether it’s legitimate, contact us directly 858-547-7400 or visit your local branch. Never use phone numbers or links provided in the suspect message or email.

Stay Vigilant

Staying safe online requires awareness and caution. At Cabrillo Credit Union, your security is our top priority. By staying informed and following these tips, you can help protect yourself from account takeover scams and other fraudulent activities.

If you have any questions or concerns about your account's security, please don’t hesitate to reach out to us. We're here to help. Stay safe!