Facing a Government Shutdown? Here's How to Prepare with Cabrillo's C.A.R.E. Program

At Cabrillo Credit Union, we understand how uncertain these moments can feel. That’s why we created the C.A.R.E. Program (Cabrillo Advanced Relief Effort), a proactive financial safety net designed specifically for times like these.

Preparing for a Paycheck Disruption

A government shutdown or unexpected event can create financial stress, especially if paychecks are delayed. Taking a few proactive steps can help you feel more secure and ready to manage the impact.

- Build a small emergency fund

Set aside whatever you can, even a small amount each pay period, to create a cushion for essentials like groceries, gas, and utilities.

- Prioritize essential expenses

Make a list of your must-pay bills—such as housing, food, and transportation—and focus on covering those first.

- Review automatic payments

Check your accounts for scheduled auto-payments. If needed, adjust or pause them to keep control of your available funds.

- Cut back temporarily

Reduce discretionary spending (eating out, subscriptions, or extras) so you have more available cash if income is disrupted.

- Know your resources

Stay informed about assistance programs available through Cabrillo Credit Union, including the C.A.R.E. Program, designed to support members during times like these.

APPLY NOW

💡 How Cabrillo’s C.A.R.E. Program Can Help

Our C.A.R.E. (PLOC) Program was designed to provide emergency financial support to eligible federal employees during times of uncertainty in a government shutdown. C.A.R.E. gives you early access to a line of credit—before your finances are disrupted.

Program Highlights*:

- 0% interest for the first 60 days from activation date.

- Pre-Approved Access to Emergency Funds

- No Immediate Need to Draw Funds—Just Be Prepared

🔓 Apply Now

Waiting until after a shutdown to secure financial help could put unnecessary strain on your household. The best time to apply for C.A.R.E. is now—before any income interruption occurs.

How to Apply For C.A.R.E.

Proactively protect your financial well-being.

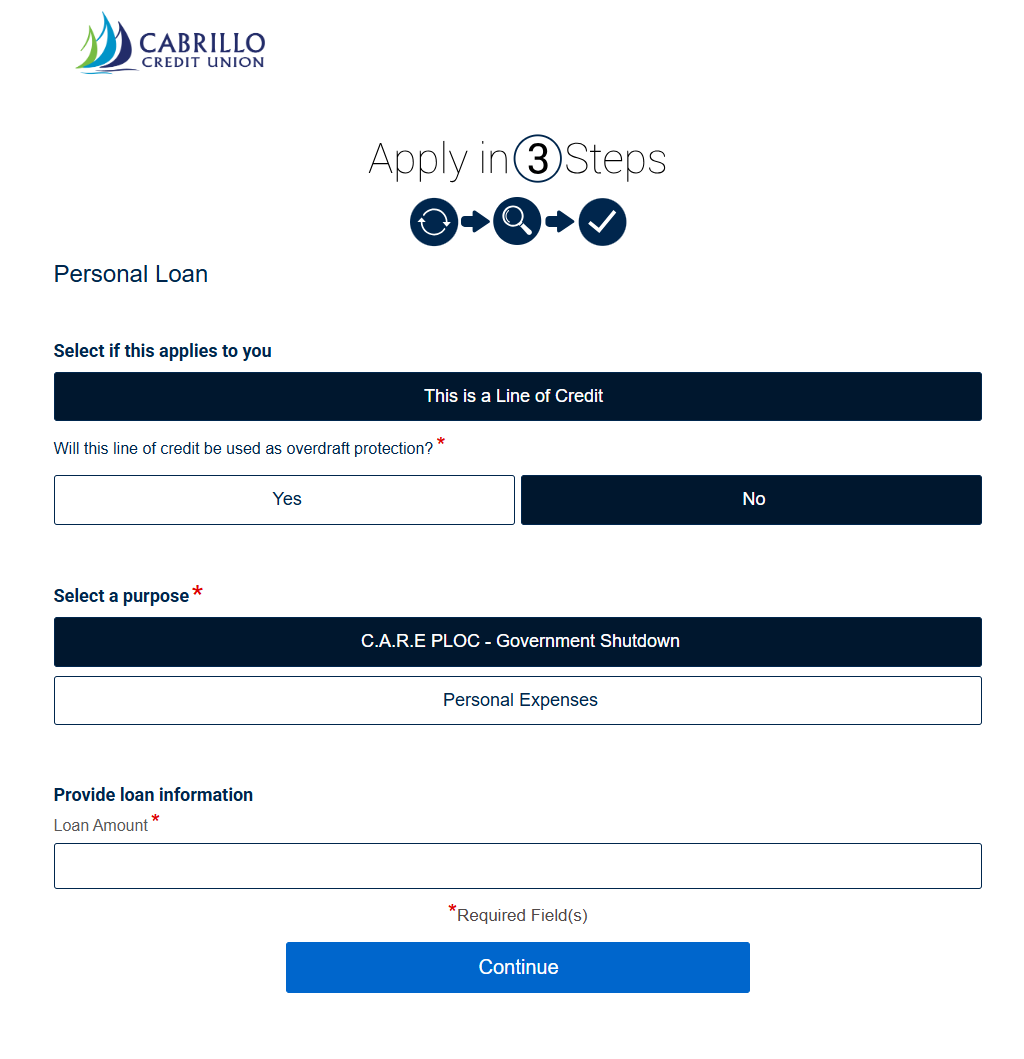

Follow these steps to complete your application for C.A.R.E.

- Select “This is a Line of Credit”

- Select “No” to Will this line of credit be used as overdraft protection?

- Click on Cabrillo Advanced Relief Efforts (C.A.R.E. Program)

APPLY NOW

For more information on C.A.R.E., please contact a Cabrillo Representative.

Cabrillo Credit Union is proud to support our members in a government shutdown. If you have questions or need assistance, please don’t hesitate to reach out to our team.

*Eligibility requirements apply. Availability of funding is periodic and related to the status of the applicable declared emergency. Proof of hardship is required. Subject to credit approval. All offers and loan program are subject to change and may be terminated without notice.